Utah offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Energy Systems Tax Credit

Energy Efficiency

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Utah State Capitol

350 North State Street

120 State Capitol

Salt Lake City, Utah 84114

(801) 538-3074

Hours: M–T 7:00am–8:00pm

Hours: F–S & Holidays 7:00am-6:00pm

Rocky Mountain Power

1407 W North Temple St,

Salt Lake City, UT 84116

(888) 221-7070

Energy Division

Utah Office of Energy Development

288 N 1460 W, Ste 400

Salt Lake City, UT 84116

Phone: (801) 538-8732

Email: [email protected]

Hours: M-F 9:00am – 5:00pm, subject to change

Salt Lake City Weather Bureau

2242 W. North Temple

Salt Lake City, UT 84116

Phone: (801) 524-5133

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Rocky Mountain Power Wattsmart Battery Rebate | $400/kW of battery capacity during the first year, additional $15/kW the second year onward | Rocky Mountain Power customers with qualified batteries |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Utah Clean Energy

Laws & Incentives

Home Energy Efficiency

Renewable Energy Systems

Home Energy Assistance Target (HEAT) Program

Weatherization Assistance Program

Power Outage Map

Utah Office of Energy Development

288 N 1460 W, Ste 400

Salt Lake City, UT 84116

General Office Number:

801-538-8732

Tax Credits Number:

801-538-8682

Email:

[email protected]

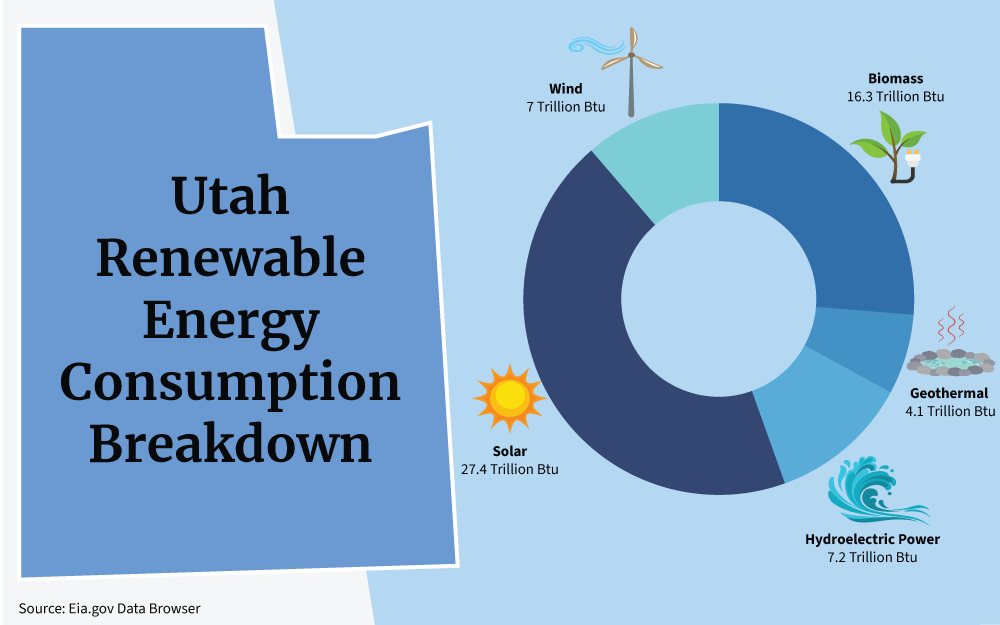

Utah Solar Energy Overview

Abundant sunshine and easy-to-register Utah solar incentives make the state an ideal place for home solar power systems.

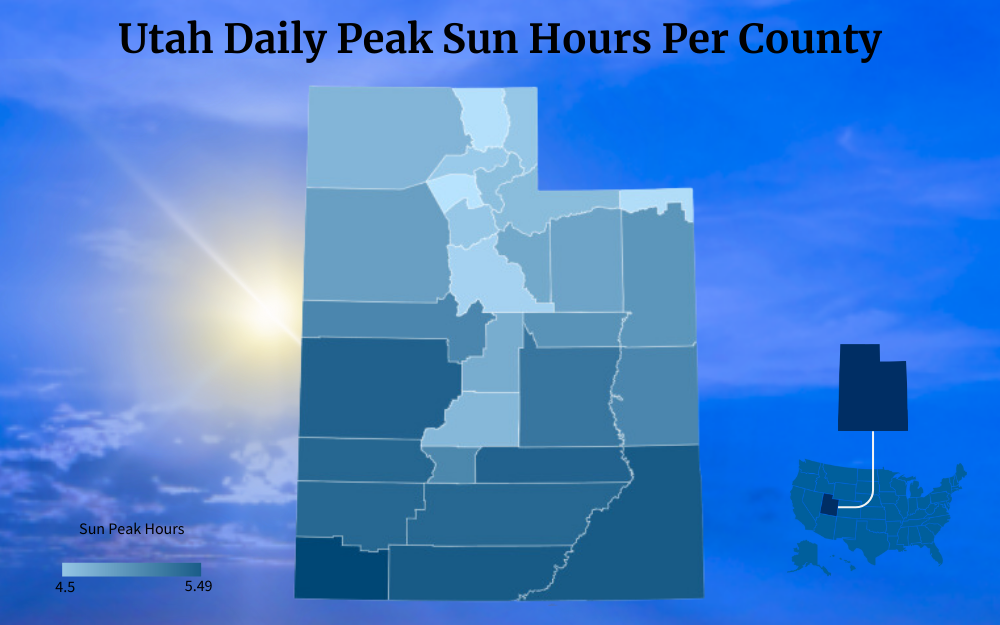

Although Utah gets more sun than most other states, with 238 sunny days per year, and is ranked 13th nationally in number of solar installations, building more renewable energy options is key.

Utah has a voluntary Renewable Portfolio Standard (RPS). This means that utility companies here are not required to derive their energy from renewable sources like rooftop solar which translates to fewer solar incentives for residents compared to other states.

But, that doesn’t mean that you can’t take advantage of federal Energy Efficiency and Renewable Energy programs and rebates provided to residents.

This guide explains how you can reduce your energy bills and become energy independent by registering for Utah solar incentives.

Utah’s Current Energy Costs

The state has a very restrictive and underfunded state solar tax credit compared to other states that might not even exist in 2024. Also, despite enacting S.B. 99 for the Public Service Commission the authority to develop a renewable energy credit (REC) system,1 the commission is still yet to do so.

Although electricity rates here, at 10.44 per kWh, are already lower than the national average, it is still well worth it for you to switch to green energy.

What’s more, with the available Utah solar incentives, this process is easier and more affordable than ever before. The average cost of a new solar system in Utah is around $21,440 before incentives which is thousands less than the U.S. average.

Additionally, most Utah homes need a smaller than usual solar system size and when you factor incentives, your out of pocket expenses for going solar are significantly reduced.

Solar Panel Tax Credits in Utah

As a resident in Utah, you have access to federal and state tax credits that deduct a percentage of your residential solar system costs from your income taxes.

These incentives significantly lower your investment and out-of-pocket expenses when you decide to switch to solar.

The Federal Solar Investment Tax Credit (ITC)

The Federal Solar Investment Tax Credit (ITC) offers a 30% credit which reduces your income tax liability dollar-for-dollar.2 This incentive applies to solar photovoltaic systems installed before December 31, 2032.

Starting 2023, energy storage solutions (batteries) are also included in this calculation regardless of whether they are charged by your solar panels or by the grid.

The ITC credit works by deducting 30% of your total pre-incentive solar installation costs from your federal income taxes owed for that year.

For example, if you owe $5,000 in federal taxes and your solar system costs $15,000, you will deduct $4,500 (30% of $15,000). As a consequence, your tax bill will be lowered from $5,000 to only $500.

What’s more, there is no dollar amount cap on the ITC. Therefore, whether your solar system costs $10,000 or & 100,000, you are still eligible for the 30% tax credit.

It is not difficult to see why the ITC is the most impactful solar incentive in the country since its inception in 2005.

So, what do you need to qualify for the full 30% federal solar tax credit?

- The solar PV system must be installed at your primary or secondary U.S. residence.3 Rental properties do not qualify.

- You must directly own the solar system,4 not lease it or buy solar power through a PPA.

- The solar equipment must be new and not used previously. You can only claim the ITC on an original installation and not a repurposed or upgraded system.4

To claim the ITC in Utah, you will need to file IRS Form 5695 along with your standard Form 1040 when you submit your federal tax return.5 You will also need to provide your installer’s contact information as well as documentation showing your installation costs.

This includes receipts and invoices for equipment purchases, installation labor, permitting costs, and any other expenses related to the installation. The tax credit paperwork is simple for most homeowners but it is best to consult a tax attorney if you need assistance.

In case your tax liability for the year is less than your tax credit from ITC, you get to roll over the remaining credit year to year until it is finished or up to 5 years.

Renewable Energy Systems Tax Credit (RESTC)

The Utah Renewable Energy Systems Tax Credit (RESTC) offers a state tax credit for residential solar panel installation.6 Utah Renewable Energy Systems Tax Credit program allows you to deduct 25% of your total equipment and installation costs, up to a maximum of $400.

This one-time credit applies in the tax year when your solar PV system is installed and does not conflict with claiming the federal ITC.

The RESTC has the following limitations:

- 25% of your total solar installation costs or $400 maximum for solar PV – whichever is lower

If you were to install an average 6kW solar panel system valued at $21,440, an uncapped 25% tax credit would slash $5,360 from your state income tax burden that would even roll over for multiple years in other states. Unfortunately, you can only claim $400 from this amount in Utah which is only 1.87% of your total solar installation cost.

This state tax credit has gradually gone down since 2017 (when it was capped at $1,600) and is set to expire on December 31, 2023 unless the state legislators decide to renew it.

To claim the credit, you will need to apply through the Utah Office of Energy Development’s website and pay the $15 application non-refundable fee in accordance with Utah Code 63M-4-401.7 You need to pay this fee using a credit card and note that paying the fee does not guarantee that you will be approved.

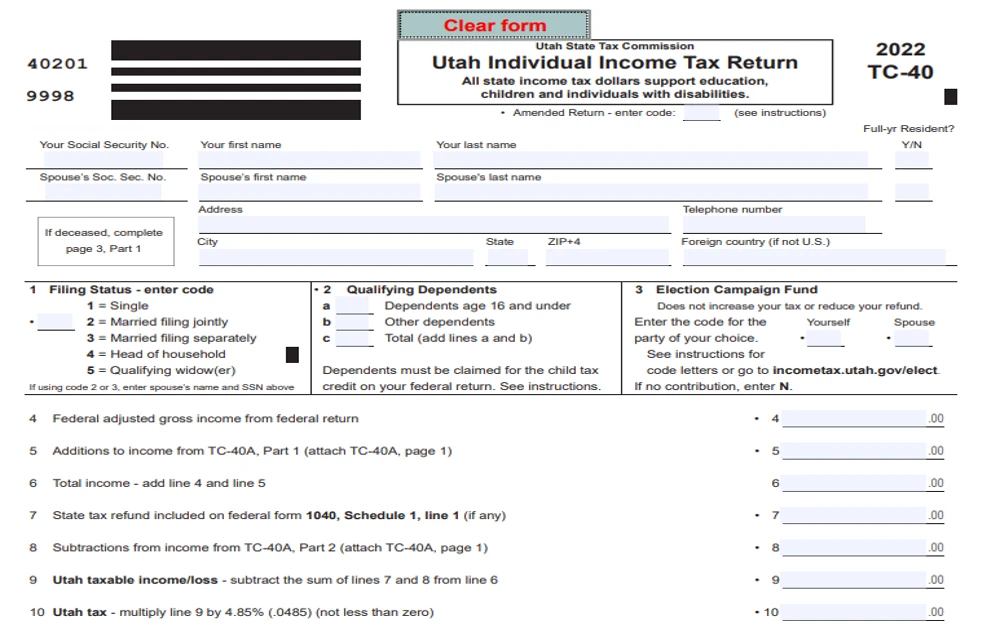

If your application is approved, you will receive a TC-40E form that will allow you to formally deduct the credit when filing your Utah income taxes.

ITC Tax Credit Options

In addition to the two main tax credits above, you can also utilize these other government solar panel program and solar incentives available to Utah residents:

Solar Easements and Rights

Although this is not a financial solar panel rebate, Utah’s solar easement law allows you to get the most value out of your solar system.8 Solar modules need to have unobstructed exposure to sunlight in order to generate the maximum possible energy.

As such, this initiative gives you a right and the power to negotiate and enter into an enforceable agreement with neighbors, homeowners’ associations, and developers to prevent the shading or obstruction of your solar panels. Solar easements are voluntary contracts that can help you protect your system investment.

Note that this is a legally binding agreement and you might need to offer some sort of compensation for entering the agreement.

Utah’s solar rights law also limits how much towns and cities can restrict you from installing a solar system in your home.8 With proper permitting, you have every right to install solar panels on your home and enjoy unobstructed exposure.

Wattsmart Battery Program (RMP)

Rocky Mountain Power, the largest rate-regulated public utility in Utah, offers its customers incentives for installing solar batteries alongside their solar panels. With the Wattsmart Battery Program,9 you get:

- A $400 upfront rebate per kW of battery you install up to $12,000 maximum, which covers up to 70% of your battery costs. With an average 5kW battery capacity, you get a $2,000 cash back incentive.

- Ongoing $15 per kW annual bill credits starting in year 2

To qualify for this rebate, you will need to install solar batteries approved by RMP then complete an application for the battery rebate program on their website. You will also need to provide information about your batteries and their total capacity, as well as contact information of your solar panel installation company.

Local Solar Incentives

Some municipalities and local utility companies also offer solar incentives or net metering programs to encourage locals to switch to solar.

- If you live in Murray, your utility company will offer local utility company will offer you net metering at full retail price as mandated in some states. This will save you more money.14

- Like in Murray, if you live in St. George, your local utility company will provide you with full and proper access to net metering at full retail rates allowing you to save more money.15

Your utility company might also offer more parks relating to energy efficiency upgrades such as smart thermostats, and solar water heaters. One provider will offer you a rebate up to $750 for installing a solar water heating system in your home.

Check with your city and electric provider to find out what local solar incentives may be available to you.

How Can I Apply for Solar Tax Credits in Utah?

To earn the full federal and state solar tax credits available in Utah, your applications must meet all eligibility conditions and include proper documentation.

Federal Solar Tax Credit

You must own your solar system and not lease it or buy solar power. Additionally, the system must be installed at your primary or secondary residence before 2033.

To claim the federal ITC, file IRS Form 5695 along with your standard income tax return.5 Submit invoices and any documentation that shows your total project costs.

Utah’s Renewable Energy Systems Tax Credit

To qualify for Utah’s RESTC, your rooftop solar PV system must be installed and approved before December 31, 2023.

Follow these steps to claim the state credit:

Step 1. Register and apply on the Utah Office of Energy Development website.7 Pay the $15 application fee.

Step 2. If approved, you will receive a TC-40E tax form to deduct the credit when filing your Utah income tax return.7

Step 3. When filing state taxes, submit the TC-40E along with documentation of your total equipment and installation costs.13

Note that this credit is set to expire at the end of 2023 so act fast.

Be sure to apply for any credits and incentives you qualify for to maximize your Utah solar savings!

Solar Panel Installation Costs

The average cost for installing a full solar PV system when buying solar panels for house in Utah is approximately $21,440. The exact price depends on factors like your system size, equipment quality preferences, and financing options, but opting for low cost solar panels could make the project more affordable.

Here are the essential elements that contribute to the overall cost of solar panel installation (Utah):

Solar Panels

Your solar panels, often referred to as solar sheets, alone will account for about 40% of the overall system cost. Most homes choose monocrystalline or polycrystalline silicon panels, with solar panel life expectancy of 25-30 years.

You can expect to pay anywhere from $2 to $4 per Watt for efficient panels from top brands. If you’re considering solar kits, these costs could be part of the package.

Inverters

Inverters convert the DC electricity from your solar panels into usable AC power for your home. Microinverters on each panel are ideal as they optimize your energy collection but cost more than central string inverters.

Plan on spending anywhere from $0.20 to $0.40 per Watt on quality inverters.

Batteries

Solar batteries are very popular in Utah. Pairing your solar panels with batteries allows you to store excess energy for use at night especially if you are not on a net metered connection.

Lithium-ion batteries start around $7,000 for a 9kWh battery and will serve you for 8 to 15 years of service. Installing batteries significantly increases your system costs but will maximize your energy independence.

Thankfully, programs like the Wattsmart Battery Program can assist you when adding batteries to your solar system.

Racking

Durable aluminum and steel racking will securely mount your solar array onto your roof. Roof-penetrating racking on asphalt shingles costs between $1 and $3 per Watt including installation but ensures wind resistance.

On average, racking and mounting will cost you $1,000 to $2,000 for a 6kW system.

Wiring and Components

Don’t forget other electrical accessories like solar circuit combiners, disconnect boxes, junction boxes, and wiring needed to connect and control the solar system. These components will cost you around $1,000 to $2,000 for full wiring and conduits.

Monitoring System

While optional, monitoring lets you track solar production, lifetime savings, solar panel problems and system issues. Basic monitoring costs between $500 and $1,500 while premium monitoring can cost more.

How To Use a Residential Solar Panel Calculator

Installing residential solar systems in your home is a big project, an investment. To weigh if solar power is right for your Utah home, it is best to use an online solar calculator for a free estimate.

Quality calculators use a series of inputs from you to estimate your optimal system size, energy output, and cost savings.

Calculate System Size

First, the calculator will ask for your address so it can determine the solar potential of your area. Next, it will have you enter your average monthly electricity bill amount.

From these inputs, the calculator can estimate the ideal system size to match and exceed your household’s energy usage.

Estimate Energy Production

Next, enter details like your roof type, roof slope, and orientation. This helps the calculator estimate annual energy production using local weather data and by modeling sunlight exposure on your specific roof.

It combines this with the system size to forecast kWh output.

Estimate Cost Savings

Finally, you’ll enter your utility company and rate. Combining your rates, the bill offset from projected energy output, and estimated system cost gives the calculator your potential return on investment.

It will estimate your payback period along with lifetime electricity cost savings.

Quality solar calculators show their methodology and let you adjust variables like equipment choices and incentives. This allows you to optimize the financial projections before moving forward.

How Do Net Metering and PPA’s Work?

These are two popular programs that can help you maximize your solar savings over time, net metering (NEM) and power purchase agreements (PPAs).

Net Metering in Utah

Net metering lets you earn green energy credits for the excess solar energy produced by your solar panels and then fed into the grid as part of the state’s Renewable Portfolio Standards (RPS).10 Although Utah has voluntary RPS, Rocky Mountain Power and some municipal utilities do offer net metering programs.

This allows customers like you to “sell” extra power to your utility at fixed per-kWh rates and accumulate credits.

For example, if your solar panels produce 500 kWh of excess energy one month, you will earn energy credits at the buyback rate. When your panels underproduce energy in a future month, you can redeem credits instead of buying electricity from the grid.

This offsets your costs and speeds up repaying your solar investment. Rocky Mountain Power has the largest net metering program in Utah and will pay 5.636 cents per kWh from June to September and 4.745 cents per kWh from October to May.11

They also allow you to roll over unused credits month to month although unused balances will expire once per year.

To enroll, have your solar installer connect your system to the grid and apply for interconnection with your utility company. There are usually minimal fees involved with getting net metering approved.

Power Purchasing Agreements (PPAs)

If you want to go solar but don’t have the upfront cost, a PPA lets you have a complete solar system installed in your home for which you are then required to pay a fixed monthly rate to a solar company that owns the equipment. PPAs require little to no money down and lock in at a lower rate than grid electricity which counts as savings.

On the downside, you don’t own the system or earn incentives such as the ITC and the state tax credit. That said, a PPA will allow you to enjoy lower electricity bills from the start at zero upfront cost while supporting renewable energy.

How To Find UT Solar Panels

As with any home improvement project, the devil is in the details. The worth you get from your solar setup hinges on the quality of the system, which encompasses your selection of solar panels and the installer.

If you’re interested in how to make solar panels yourself, keep in mind that the quality of materials and workmanship will directly affect the system’s performance.

With so many solar companies to choose from, here are some best practices to help you find a trustworthy Utah installer with proven expertise:

- Check online reviews and ask neighbors for installer referrals. Local word-of-mouth recommendations can help pre-screen quality firms.

- Look for an established company with a long track record in Utah. Ask how many years they’ve been in business and number of installations they’ve done locally.

Local knowledge and experience are invaluable. - Compare quotes from 3-5 installers. Review the itemized costs closely for equipment and labor.

- Verify that all contractors have active licensing, insurance, and requisite solar credentials. NABCEP certification is ideal.12

- Inspect warranties on equipment and workmanship. Look for 10-year minimum inverter warranties and 25-year panel warranties.

- Research the panel brands and model numbers being offered to ensure optimal efficiency and output.

- Give preference to installers located near you for proximity, service availability, and familiarity with local building codes.

Doing diligent research helps you choose a solar provider with the expertise and track record needed to maximize your return on investment.

With abundant sunshine and solar stimulus like tax credits and net metering, Utah is poised to continue growing its solar market. Hopefully, with the state’s 20% RPS by 2025, programs like net metering and the Renewable Energy Systems Tax Credit will be expanded to encourage more residents to switch to solar.

A solar investment provides long-term electricity bill savings while allowing you to produce clean renewable power. And the more Utahns who go solar, the closer the state moves towards its renewable energy goals.

Take control of your energy costs and help build a sustainable future by tapping into Utah’s solar potential. By capitalizing on the Utah solar incentives available, you can make the switch to solar energy for your home easier and more affordable.

Frequently Asked Questions About Utah Solar Incentives

Does Utah Have Any Free Solar Panel Programs?

Unfortunately, there are currently no programs in Utah to get completely free solar panels for your home. However, the upfront costs can be reduced through federal tax credits and state incentives or you can choose a $0-down solar lease or PPA.

What Is Utah's Solar Tax Credit Amount?

Utah’s renewable energy systems tax credit currently offers 25% of the cost of a solar PV system, but is limited to $400 maximum. This one-time credit will stop at the end of 2023 unless legislators decide to extend it.

Does Utah Allow Net Metering?

While not mandated statewide, many major utility companies in Utah including Rocky Mountain Power do offer net metering programs that allows you to earn bill credits at fixed rates when your solar panels produce excess energy. Check with your electric provider to see if net metering is available.

References

1Utah State Legislature. (2009). RENEWABLE ENERGY CERTIFICATE. Utah State Legislature. Retrieved September 15, 2023, from <http://le.utah.gov/~2009/bills/sbillenr/sb0099.htm>

2US Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3U.S. Government Publishing Office. (2011). 26 U.S.C. 25D – Residential energy efficient property – Content Details – USCODE-2011-title26-subtitleA-chap1-subchapA-partIV-subpartA-sec25D. GovInfo. Retrieved September 15, 2023, from <https://www.govinfo.gov/app/details/USCODE-2011-title26/USCODE-2011-title26-subtitleA-chap1-subchapA-partIV-subpartA-sec25D>

4U.S. Government Publishing Office. (2020). 26 U.S.C. 25D – Residential energy efficient property – Content Details – USCODE-2011-title26-subtitleA-chap1-subchapA-partIV-subpartA-sec25D. GovInfo. Retrieved September 15, 2023, from <https://www.govinfo.gov/app/details/USCODE-2020-title26/USCODE-2020-title26-subtitleA-chap1-subchapA-partIV-subpartA-sec25D>

5IRS. (2023, February 17). About Form 5695, Residential Energy Credits | Internal Revenue Service. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

6Utah State Tax Commission. (2023). Renewable Energy Systems. Utah State Tax Commission. Retrieved September 15, 2023, from <https://incometax.utah.gov/credits/renewable-energy-systems>

7Utah Office of Energy Development. (2023). Renewable Energy Systems Tax Credit (RESTC). Office of Energy Development. Retrieved September 15, 2023, from <https://energy.utah.gov/homepage/tax-credits/renewable-energy-systems-tax-credit/>

8Utah State Legislature. (2023). Index Utah Code Title 57 Real Estate Chapter 13 Solar Easements. Utah State Legislature. Retrieved September 15, 2023, from <https://le.utah.gov/xcode/Title57/Chapter13/57-13.html?v=C57-13_1800010118000101>

9Rocky Mountain Power. (2023). Wattsmart Battery program. Rocky Mountain Power. Retrieved September 15, 2023, from <https://www.rockymountainpower.net/savings-energy-choices/wattsmart-battery-program.html>

10Center for the New Energy Economy. (2018). State Brief: Utah. Center for the New Energy Economy. Retrieved September 15, 2023, from <https://cnee.colostate.edu/wp-content/uploads/2018/09/State-Brief_UT_Sept-Update.pdf>

11Rocky Mountain Power. (2023). Customer Generation. Rocky Mountain Power. Retrieved September 15, 2023, from <https://www.rockymountainpower.net/savings-energy-choices/customer-generation.html>

12NABCEP. (2023). Certifications. NABCEP. Retrieved September 15, 2023, from <https://www.nabcep.org/certifications/>

13Utah State Tax Commission. (2022). 2022 Utah TC-40 Individual Income Tax Return. Utah State Tax Commission. Retrieved September 15, 2023, from <https://tax.utah.gov/forms/current/tc-40.pdf>

14State of Utah. (2023). Murray City Power. Murray City Power. Retrieved September 15, 2023, from <https://www.murray.utah.gov/77/Net-Metering-Program>

15Utah Clean Energy. (2019). Connecting Your Solar to the Grid & Export Credit Rates. Utah Energy Hub. Retrieved September 15, 2023, from <https://hub.utahcleanenergy.org/solar-power/for-homes/connect-to-the-grid/>